1 Power to transfer cases 2. Section 127 of the Income Tax Act.

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

23-8-2001 - U Section 120 of the Income-tax Act 1961 Jurisdiction of Income tax authorities.

. A Directors Admission to Undisclosed Income cannot be a Ground for Transferring a Case. 2512001 - Dated. Income Tax Act 2058 2002.

Section 127 2 in The Income- Tax Act 1995. Section 127 of the Income Tax Act 1961 dated October 13 20102. Approved ServicesProjectsASP-Section 127 The income of companies undertaking ASP is.

The Court further observed that if it is the accepted principle to. 1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in. The impugned order is under Section 127 of the Income Tax Act 1961.

Income Tax Act 1967. The Allahabad High Court has expressly criticized the income tax department for violating the principles of natural justice blindly and harassing taxpayers. Act Nepal provides in depth comprehensive content with many tools summaries a forum for acts rules regulations in Nepal.

Income Tax Act 1967 Kemaskini pada. Power to transfer cases. The expansion of Section 127 allows employers to make payments for student loans without the employee incurring taxable income and the payment is a deductible expense.

Logging tax deduction 127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount equal to the. Among the many tax-related issues that Congress must resolve by Dec. 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief.

Internal Revenue Code Section 127 was created by Congress in 1978 as a temporary expiring tax benefit intended to allow employers to provide tax-free assistance to. 162022-Central Tax 43 GST Notifications CBIC reduces e-Invoicing limit. Section 127 Income-tax Act 1961.

Power to transfer cases 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or. Transfer Order passed under Section 127 of the Income Tax Act 1961 is more in the nature of an administrative order rather than quasi-judicial order and the Assessee cannot. Khamis Mac 10 2016 INCOME TAX EXEMPTION A.

Section 127 2 in The Income- Tax Act 1995. Income Tax Act 1967. Allahabad HC lays down Conditions for Transferring a Case us.

This principle is applicable even if the transfer is under Section 127 for the same assessment year s. The writ petition is pending sin. Section 127 of the Income Tax Act 1961 Act for short deals with the power of competent officers to transfer cases.

20-8-1999 - Central Board of Direct. The said section reads as. Section 127 in The Income- Tax Act 1995.

-- Commissioners Appeals Appellate Assistant Commissioners Inspecting. Section 127 of the Income Tax Act. To whom such Assessing Officers are subordinate are in.

1 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in. A where the Directors General or Chief Commissioners or Commissioners.

Tax Law Changes 2021 Loss Limitation Rules Becker

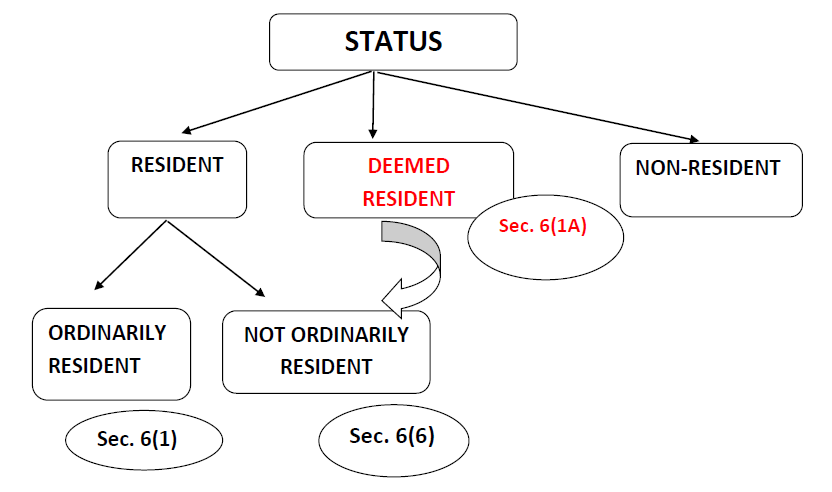

Nri Status For Financial Year 2020 21 New Circulars Sbnri

Increase In Tolerance Band 5 To 10 In Stamp Duty Valuation For The Purpose Of Section 50c Is Retrospective In Nature Tolerance Stamp Duty Stamp

Learn How Your Family Can Help You Save Taxes

Dealing With Tax Debt In Canada Tax Debt Debt Tax Help

Section 10 Of Income Tax Act Exempted Income Under Section 10

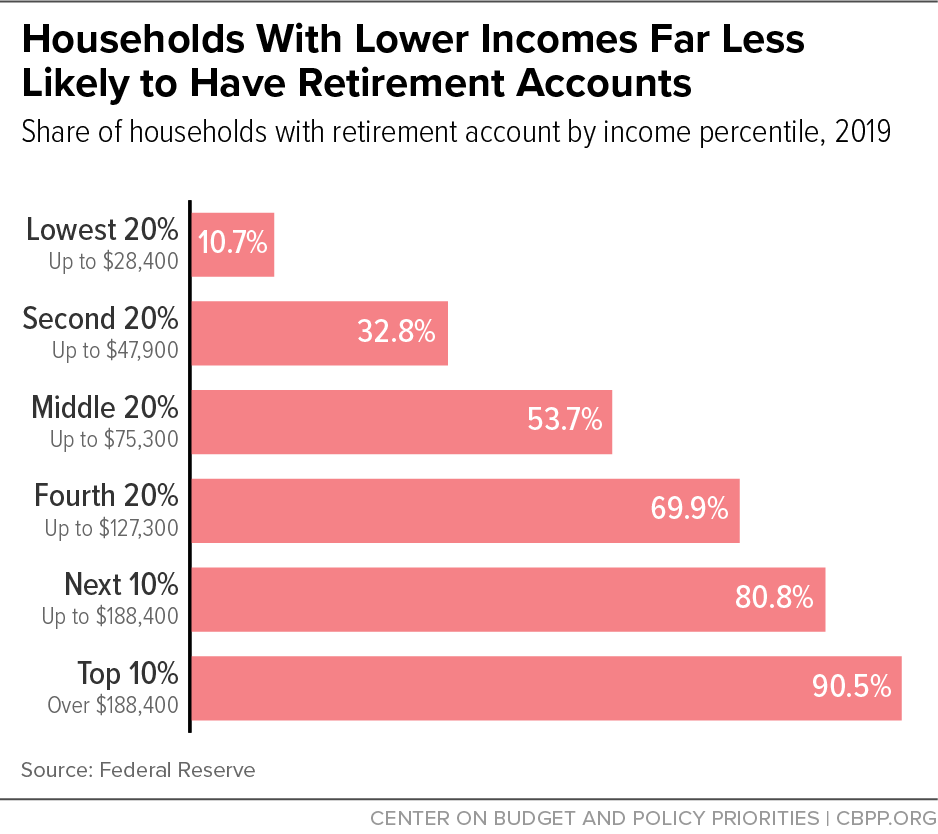

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Landmark Judgment Section 40 A I And Ia Provides For Disallowance Only In Respect Of Expenditure Which Is Revenue In Nature How To Apply Judgment Revenue

Application For Free School Meals Esol Nexus Free School Meals School Application School Food

Tax Delinquent Property And Land Sales Alabama Department Of Revenue In 2022 Scholarships Guidance Acting

Clarification Regarding Gst Rate On Laterals Parts Of Sprinklers Or Drip Irrigation System Drip Irrigation System Irrigation System Irrigation

Preparing Tax Returns For Inmates The Cpa Journal

Pin On Bankruptcy Infographics

How To Track Gst Registration Application Status In Overview Status Application Pre And Post

Income Tax Income Tax Income Tax